Detailed Ally Bank Reviews in 2024 [Banking Services & Customer Experience]

Key Highlights:

- Products: Loans, Credit Cards, Savings and Checking accounts, CDs and MMA’s investment accounts, and certificates of deposits.

- Fees: Outgoing domestic wire transfer fees, ATM refunds.

- High APY

- No minimum balance maintenance requirement

- Low Minimum Deposit

- No charges for overdrafts

Ally Bank has been serving the people since 2009, and offering a cluster of banking services by charging nominal fees. It is one of the best options for those who prefer digital banking.

Are you thinking of opening a bank account with Ally Bank? Our Ally Bank review could help you clear your thoughts and gain some knowledge about this bank.

This Ally review focuses on its fee structure, banking products offered by this bank, and much more. Let’s get started!

About Ally Bank

Ally Bank was first incorporated in 2009, earlier it was known as GMAC (General Motors Acceptance Corporation). It was widely known for its services related to consumer finance, car insurance, dealer financing, and later mortgage financing, and real estate.

The bank offers a cluster of services and features to customers, including loans, credit cards, checking and saving accounts, and many more. The main thing that sets it apart from other banks is that it is entirely online and has no physical branch.

Additionally, this bank is widely popular for high-interest rates. Ally bank ratings and Ally high yield savings reviews are quite good, which makes it quite popular among users. It has built trust among users and is backed by the goodwill of General Motors.

Also Read: Clark Receives $69M in Series-C Round Led by Tencent

Detailed Ally Bank Reviews of Banking Products

There are a bunch of banking products and services offered by this bank, let’s execute Ally Bank reviews in detail.

Ally Savings Account

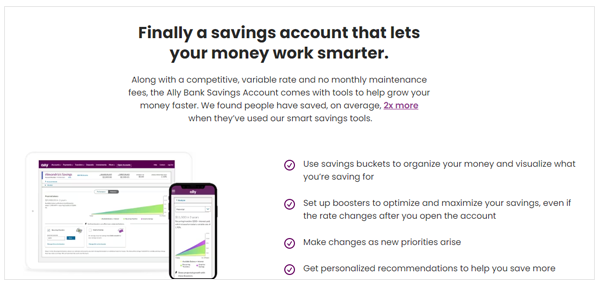

Let’s begin with an Ally savings account review, which is one of the best banking services offered by this bank.

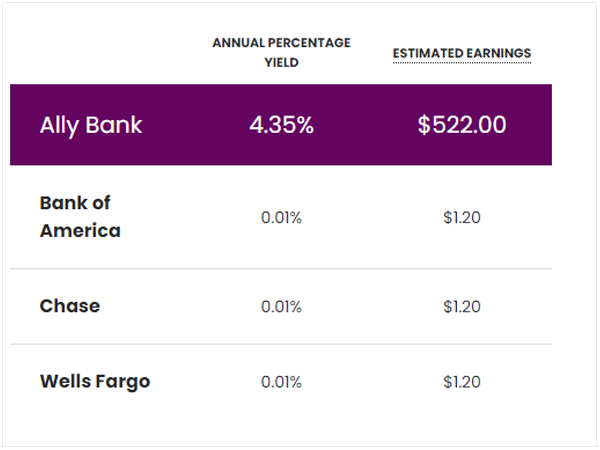

The best online savings accounts typically offer higher savings deposit rates, and Ally Bank is no exception. Although the APY won’t make you wealthy, it usually offers a higher rate than a regular bank.

With its savings account, Ally Bank offers an annual percentage yield (APY) of 4.35%, more than ten times the national average.

Other highlights of the savings account include the following:

- Envelopes for the deposit paid postage

- Recurring automatic transfers (to speed up savings)

- No upkeep costs per month

- No requirements for a minimum balance

This concludes the Ally bank savings account review; however, it is important to note that no more than six select withdrawals and transfers may be made in total within any given statement period. There is a $10 fee for each transaction exceeding the limit with Ally Bank.

Ally Checking/Spending Account

With its interest-bearing account, Ally provides a means of earning interest. Rates are determined by the balance in your account; however, there is no minimum initial deposit or recurring balance requirement. One advantage of not having physical branches is that the bank can pass on those savings to customers in the form of lower fees.

Some highlights of the checking account are as follows:

- Minimum balances each day for amounts under $15,000–0.10% APY

- When using an Allpoint ATM, account holders are never charged.

- $15,000 and above minimum daily balances are subject to a 0.25% APY.

- There is no minimum deposit required to open the account, and there are no monthly fees for customers.

- If you use one of the 43,000+ ATMs in the Ally network, you can get up to $10 cash back each statement cycle.

- Furthermore, Ally does not impose overdraft fees.

- Free basic checks, a debit card, and bill-paying services are provided to customers.

Note: Free checks and a debit card are included with Ally’s online checking accounts, and there are no fees to use AllPoint ATMs nationwide.

Money Market

It provides a money market account that pays an annual percentage rate (APY) of 4.40% on all balance categories in addition to savings accounts.

Ally’s money market account rates are still better than those of traditional banks, even though they are on par with those of other online banks.

Despite not providing the highest yields in the US, Ally Bank is regarded as one of the finest financial institutions out there.

The following are some other important features:

- Ally money market accounts also come with the ability to write checks.

- Even ATM fees from non-network ATMs are reimbursed by Ally, up to $10 per statement cycle.

- Additionally, free access to the AllPoint ATM network and a debit card are provided to customers.

- ATM withdrawals are unlimited, but there is a six-transaction monthly cap that is subject to a $10 fee for each transaction over the cap.

- There is no monthly fee or minimum beginning deposit for money market accounts.

Certificates of Deposit

To accommodate the needs of savers, Ally Bank provides a range of periods and varieties for certificates of deposit (CDs). It offers three different types of CDs.

High Yield CDs

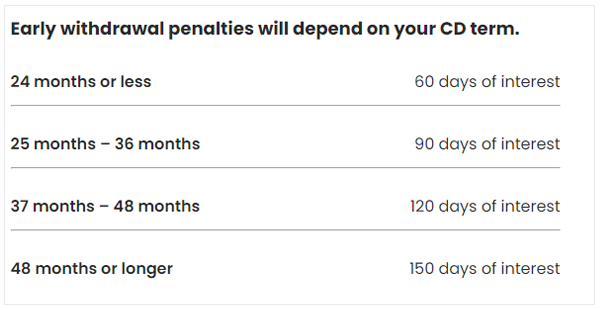

It provides sentences ranging from three months to five years. 5.15% APY is possible for customers, depending on the conditions they select. Both a minimum deposit requirement and monthly fees are absent. Penalties for early withdrawals include up to 150 days’ worth of interest.

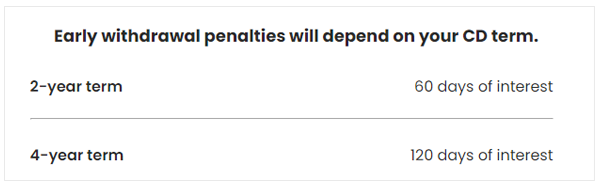

The early withdrawal penalties on raise-your-rate and high-yield CDs differ depending on the term. The bank assesses a 60-day interest charge for maturities of 24 months or less.

If the terms are between 25 and 36 months, the penalty increases to 90 days of interest. The cost for maturities ranging from 37 to 48 months is 120 days‘ interest. Additionally, there is a 150-day interest fee for durations greater than 49 months.

No Penalty CDs

It has an APY of up to 4.35%. Savers seeking liquidity can use Ally Bank’s No Penalty CD. Customers can withdraw money from this product without incurring any fees. After the CD is funded for the seventh day, you can begin taking withdrawals from your account.

This CD offers one of the best CD rates on no-penalty CDs, with an 11-month term and an APY.

Raise Your Rate CDs

Additionally, Ally Bank provides two and four-year maturities for its Raise Your Rate CD. For the two years, you can raise your rate once; for the four-year term, you can increase it twice. For both terms, the APY is 4.00%.

There are no monthly maintenance fees and no minimum initial deposit needed. Additionally, early withdrawal penalties of up to 150 days of interest apply to Raise Your Rate CDs.

Also Read: Let’s Unravel How to Add Money to Venmo Without Bank Account

Other Financial Products Offered by Ally Bank

As we are done with the Ally review of bank products offered by it, let’s now dive directly into the other financial products offered by this bank.

- Home loans

- Auto loans

- Purchase mortgages

- Managed Investment Portfolios

- Refinance mortgages

- Self-directing trading

- Individual retirement accounts (IRAs)

- Corporate Financing Options

Ally Bank is quite popular not only for its banking products but also for its other financial products, which are equally enticing. You can get loans and mortgages at low-interest rates if you are an account holder at this bank.

Also Read: Multiply Your Returns on Investments with How2Invest

Pros and Cons of Ally Bank

There are a handful of pros and cons of Ally Bank and its banking services, let’s look at them in detail.

| Pros | Cons |

| It does not charge for an overdraft facility. | There is no physical branch. for this bank. |

| There is no provision for a minimum deposit. | This bank does not provide a cash deposit facility to its users. |

| You are not obliged to maintain a minimum balance in the account. | It does not permit users to execute international wire transfers. |

| This bank has a wide range of ATM networks. | |

| Users are not charged any monthly fees. | |

| It provides 24/7 customer service. |

Bank Fees Charged by Ally Bank

Let us take a closer look at bank fees charged by Ally Bank:

| Fees | Charge |

| Monthly Maintenance Fees | None |

| Overdraft Fees | None |

| Deposited Check Rejected | $7.50 |

| Excessive Transaction Fee | Your Account Could be Closed(No Charges Applicable) |

| Outgoing Domestic Wire Transfer | $20 |

| Non-sufficient Fund Fees | None |

| Expedited Delivery of Items | $15 |

| ATM Fees | None |

| Extensive Research on Your Account | $25 an hour |

Note: You can have as many transactions as you want domestically, but you cannot withdraw more than 10 times per month as per the statement cycle.

Customer Experience

Looking through Ally reviews, I discovered that Ally offers a seamless and user-friendly user experience. You can easily access your accounts and manage your funds with its website and mobile application.

You can only access Ally online; in-person assistance is not accessible. Users can contact them via phone, email, conventional mail, chat, or X (Twitter) to get their problems answered, and their comprehensive help center should address most of the commonly asked questions.

Additionally, it enhances the client experience by utilizing AI tools like conversational AI and cognitive computing.

Customer Service of Ally Bank

Ally Bank is an online bank that does not have a single physical branch. People have often complained about its customer service being unresponsive, and many people have reported that they are unaware of its customer service contact details.

If you are facing any technical issues with your Ally Bank services, you can connect with them on the details mentioned below.

Phone support is available twenty-four hours a day, seven days a week. You can connect them via phone at: 1‑888‑568‑0186 and 1-877-247-2559.

Ally also offers chat support via their website for immediate assistance. Additionally, you can submit general correspondence to its mailing address:

Ally Bank Customer Care

P.O. Box 951

Horsham, PA 19044

Also Read: How to Transfer Apple Cash to Bank Account and Debit Card With Some Straightforward Steps

Final Thoughts

To conclude this Ally review, it can be said that Ally Bank offers a full-service online bank with competitive rates, minimal fees, and no minimum account balance requirements.

It is ideal for those who don’t deposit cash frequently or use in-person services and who desire affordable rates, low fees, and simple access to customer care. It can also be a great option for people who would rather not leave their homes and stand in line to deposit or withdraw money.

I hope you found this Ally review useful. If you have any further questions, please post them in the comments section below.

FAQs

Ans: Yes, it is a good bank as it provides higher rates on savings deposits which are typically found in the greatest online savings accounts. It possesses a high APY. Although the APY won’t make you wealthy, it usually offers a higher rate than a regular bank.

Ans: Ally Bank is fully insured by the FDIC, so you can be confident it is completely safe. If the bank fails, the money in your Ally deposit accounts is protected up to $250,000 for each owner category and per individual.

Ans: It does not permit you to make cash deposits. But you can make use of other deposit methods like wire transfers, mobile check deposits, online transfers, and more.

Ans: For savings and checking accounts, income proof is not required; however, for a line of credit, credit card, loan, or mortgage, you must provide your bank statement as well as income proof.

Ans: No, you need not worry about maintaining a minimum balance for any of Ally Bank’s accounts or services.

Ans: Yes, Ally Bank’s checking accounts are FDIC-insured. Moreover, you will be glad to know that all banking products are FDIC-insured up to $2,50,000 per depositor.

Sources: