Financial Freedom Starts Here: Best Mortgage Rates Revealed

On your way to pursue financial freedom?

Most homeowners in the last few years purchased their homes at lower mortgage rates than today. Mortgage rates fluctuate now and then. Therefore, securing a favorable mortgage rate can be challenging enough.

Rising mortgage rates can leave anyone feeling overwhelmed. In support, according to the recent Empower research, 43% of Americans stated that they’re extremely or very concerned about the housing market.

In this comprehensive guide, we’ll walk you through how to get the best mortgage rates. This will help you understand what a good mortgage rate is and get an idea about current market rates.

How Does Mortgage Rates Work?

Let’s suppose a 30-year mortgage for $300,000 at a 2.97% rate would cost you around $123,000 in interest over the life of the loan. But, recently, you have to pay around $300,000 in interest for the same loan.

As you can see, even a fraction of some percent can add up over the years. Mortgage loans are usually pursued to maintain a home, land, or other types of real estate.

Here’s the thing, the borrower agrees to pay the lender over time. A lender can be a group (public or private), an individual, or a financial institution that makes funds available.

Interesting Fact In the first three quarters of 2023, Americans originated $1.1 trillion in new mortgage debt.

To break it down, 77.4% of it was issued to super-prime borrowers with credit scores of 720, and 3.6% of it was issued to subprime borrowers having scores below 620.

The borrower has to pay back in a series of regular payments divided into principal and interest. Plus, borrowers are liable to pay interest over several years. In contrast, the property then becomes collateral to secure the loan.

Since mortgages were fully amortized, regular payments stayed the same but proportions of principal vs. interest will be paid over the life of the loan along with each regular payment.

Types of Mortgages

There are private lenders as well as government-backed institutions. They purchase, guarantee, and securitize mortgages in the secondary mortgage market just like the Federal Housing Administration (FHA). There are 3 other types of mortgages.

- Simple mortgage: With a simple mortgage, the mortgagor binds himself personally to pay the mortgage money. They further agree on the terms that if they fail to pay the following amount as per the contract, then lenders shall have a right to sell the property.

- Usufructuary Mortgage: In this type of mortgage, the mortgagor delivers the possession of the property to the lender. The borrowers are retained from their possession until they are done paying with all the money.

- Anomalous Mortgage: It’s not your simple mortgage, it’s a mortgage secured by a deposit of the title deeds within the meaning of section 58.

Current Mortgage Rates

As per Bankrate, the current mortgage rates are shown in the table below.

| Loan Type | Purchase | Refinance |

| 30-Year Fixed | 6.90% | 6.85% |

| FHA 30-Year Fixed | 6.79% | 6.85% |

| VA 30-Year Fixed | 6.97% | 7.53% |

| Jumbo 30-Year Fixed | 7.04% | 6.89% |

| 20-Year Fixed | 6.77% | 6.77% |

| 15-Year Fixed | 6.48% | 6.46% |

| FHA 15-Year Fixed | 6.37% | 6.41% |

| Jumbo 15-Year Fixed | 6.56% | 6.60% |

| 10-Year Fixed | 6.36% | 6.36% |

| 10/6 ARM | 7.47% | 7.67% |

| 5/1 ARM | 6.65% | 6.47% |

| 10/1 ARM | 7.18% | 8.01% |

| Jumbo 5/6 ARM | 6.37% | 6.25% |

These were some appealing mortgage interest rates; if you want, you can also look for interest rates on home loans.

Note: The interest rate mentioned above is subject to change and varies from area to area. Please check with your bank or mortgagor to know the current rate.

What is the Good Mortgage Rate?

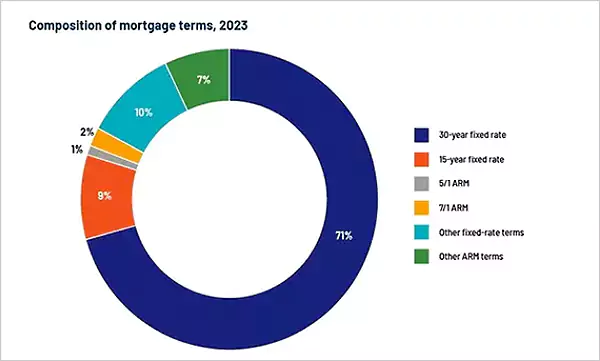

In layman’s language, a good mortgage is represented as the lowest available rate for a 30-year fixed mortgage. It significantly depends on the borrower. The following chart illustrates the existing composition of mortgage terms and originations in the US.

Although the lender offers the best lowest rates possible, in the end, it depends upon the credit history, income, down payment, and other debts (if any). It is possible that someone with a low credit score was able to obtain a better mortgage rate than someone with a higher credit score.

Factors to Consider for Better Mortgage Rates

Several factors need to be accounted for before getting a mortgage. These factors decide your mortgage rate and the following are the factors that guarantee you get the best deal:

- Good Credit Score: As previously mentioned, having a good credit score is a primary factor determining mortgage rates. Therefore, individuals with high credit scores secure a lower rate.

Do You Know?

As of now, the research has revealed that Americans owe $12.14 trillion on 84.0 million mortgages. It often comes to an average of $144,593 per person with a mortgage on their credit report.

- Increased Down Payment: A few lenders offer lower rates if individuals make a higher down payment. For instance, a down payment of 20% could get attractive rates sometimes.

- Lower your Debt-to-Income Ratio: The DTI ratio examines the total of the monthly debt obligation and divides it by the gross income. DTI of 43% or higher indicates that one may have challenges meeting their monthly obligations.

Additionally, do not open credit accounts like credit cards or personal loans, as they may temporarily lower your credit score. Once you qualify for better mortgage rates, you can save tens of thousands of dollars over the life of the loan.

Summing Up

No one can predict where rates or home prices are headed. However, as the economy weakens due to Fed policy, mortgage rates are likely to moderate.

Too many factors are at play concerning the accuracy of the rates including credit score, down payment, DTI ratio, closing cost, discount points, property taxes, HOA dues, etc.

Keep in mind that loan rates do not include amounts for taxes or insurance premiums. Bring your best to qualify for better mortgage rates and embrace financial freedom for a lifetime.

Read Next: Multiply Your Returns on Investments with How2Invest

FAQs

Ans: Home loans allow you to get actual money to buy property. On the other hand, a mortgage is the payment that you have to make to take possession of real estate. The mortgage doesn’t involve the mortgagee to lend out money, instead, it’s a legal document.

Ans: According to today’s market, good mortgage rates fall between 6-7%.

Ans: An escrow account is a concept in which a third party holds the assets or money until the transaction has been taken place by both parties.

Sources