Why You Need An Emergency Fund: A Smart Financial Safety Net

Life is filled with lots of ups and downs, and there is no telling what could happen next. It is impossible to predict how your life would go.

Just imagine what would happen if your car broke down and the repair costs were high, or if someone in your family got sick, and you were left with a huge medical bill.

So, what can you do if you’re stuck in such a situation?

Well, dipping into your emergency funds in such cases can be a lifesaver. Let’s take a closer look at the various benefits of creating a security cushion for unexpected financial crises.

The Importance of an Emergency Fund

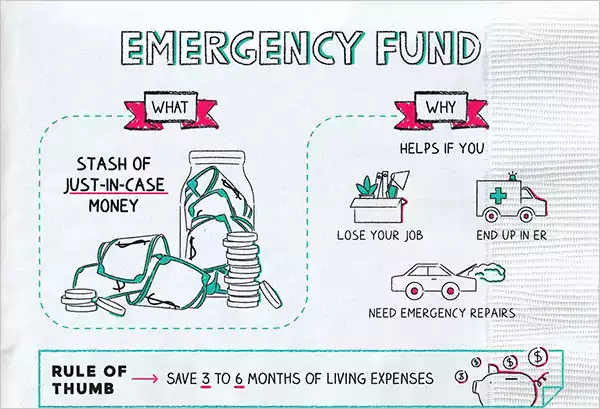

So, What exactly is an Emergency Fund? Well, it is simply the money you save up for times of crisis or emergencies.

You can use this money to cover anything from your sudden visit to the emergency room to your car’s broken axle. Emergency funds are the boats that will help you in times of a flood. It kind of acts as a safety net and stops you from having to rely on credit cards, loans, and other high-interest sources when you need some cash in case of emergencies.

Options like My Canada Payday can offer a quick financial solution, but establishing your fund is a wiser and more sustainable financial strategy in the long run.

There are many reasons that people should create emergency funds, and here are a couple of reasons why they can be of help to you:

Peace of Mind in Uncertain Times

Emergency funds are the airbags for times when the truck of life just comes straight at you, ignoring all those stop signs.

It can be anything from a job loss, a sudden illness, or a major home repair, having this fund means you won’t have to stress about finding money when you’re in a pinch.

It gives you peace of mind, knowing that you’re prepared for whatever life throws your way.

Avoiding Debt Traps

Without some kind of money saved, many people are oftentimes forced to choose some options that will put them in an endless debt cycle.

The worst culprits for this are shady payday loans or credit cards. And payday loan charges up to 400-500 % APR.

High-interest rates and fees can make it hard for a person to get free of debt and climb out of this hole.

Having some money for times like this can help you from making this mistake and keep you financially afloat and debt-free until you start making money again.

Promotes Good Financial Habits

Saving for emergencies is a good habit. If you make a habit of setting some money aside for emergencies.

This will make you more mindful of costs and help you control your spending. This can greatly help in improving your financial health. And as a rational person, you should always keep some funds aside.

How Much Should You Save?

Now, the question is how much funds should you keep in reserve? Well, there is no fixed amount that you need to save, and each case varies from person to person.

Many experts in financial planning say that you should save at least three to six months’ worth of your living expenses.

But, just like I said earlier it varies depending on your lifestyle, income, and the number of people who are dependent on your income.

Keeping a certain amount could never be enough. Even having 6 figures in your bank can deplete with just one huge medical bill. So the key is to start small and gradually increase the size. Even if you save a few dollars per day, it will add up over time.

Creating Your Emergency Fund

Well, we can say that emergency funds are a great way to be prepared for emergencies, but how do you go about creating one? Let’s take a look at how to start your very own emergency fund:

Start with a Goal

When you’re starting, you can begin by calculating and finding out how much you need to get by, and setting a realistic savings goal is also pretty important.

So, how much do you start with?

Anything from a couple of bucks to a thousand, or just enough to cover a couple of month’s worth of bills.

Make It a Habit

You need to think of your emergency fund savings like a bill. So, make it a habit to put in at least a fixed amount of money like any other bill.

Besides, you can also set up a schedule for transferring any extra money from your checking to your savings. This way it will become a lot easier for you to stick to your plan.

Find the Right Place to Keep Your Fund

You want your money to be easily accessible for emergencies to spend. You can try putting it into a savings account where it will pick up interest, or you can also put it into a trusted mutual fund that gives stable returns over the years.

This way if an emergency comes your way it will be easy to get your money out quickly.

Furthermore, investing in mutual funds makes the money inaccessible for your Christmas or Black Friday shopping spree. So, you won’t be able to spend it easily.

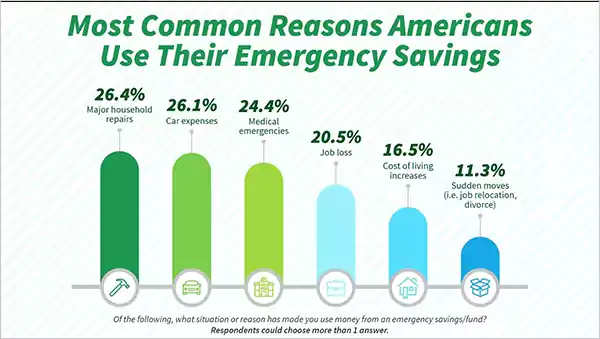

More than 26.4% of Americans use their emergency funds for major house repairs, 26.1% use it for car repairs and about 24.4% use it for medical emergencies.

Suggested read: Spy vs. Voo: Which ETF Fund Is The Best?

Final Words

Emergency funds are a necessary part of financial security. It’s not just about having money set aside, it’s about freedom and peace of mind.

Well, many things around you will make you want to spend all that money. You need to resist these temptations to spend time around you. Remember that you’re saving this money for emergencies, and it’s not meant for your everyday spending impulses.

Starting and growing your emergency fund might seem challenging at first, but the financial stability and peace of mind it provides are well worth the effort.

Read Next: Sell Gift Card for Instant Payment – 10 Easy & Effective Ways (In Cash & Payment)

FAQs

Ans: Then in this case, if you ever get yourself in an emergency, you have no other option but to go for payday loans that charge high interest.

Ans: There is no fixed portion, it all depends on your day-to-day expenses.

Ans: Put it somewhere where it is hard to convert into liquid, such as gold or silver. You can also invest your money in mutual funds, or you can issue government bonds/treasuries.

Sources:

- How to Build an Emergency Fund – Forbes