The Comprehensive Coverage of Product Liability Indemnification for Businesses

Product liability arises when the commodity or service provided turns out to be defective or faulty, which may cause harm or loss to the consumer.

In today’s consumer-driven marketplace, businesses face a myriad of risks linked with the production, distribution, and sale of goods.

From manufacturing defects to marketing misrepresentations, product damage lawsuits can pose significant financial and reputational risks for companies.

Consumer remuneration serves as a critical form of insurance protection, offering companies comprehensive guarantees against a wide range of potential liabilities.

In this article, you delve into the comprehensive coverage provided by product liability insurance and its importance for corporations.

Protection Against Manufacturing Defects

Manufacturing defects are one of the most basic sources of manufacturing negligence claims, arising when a commodity is improperly manufactured or assembled, resulting in a defect that renders it unsafe for its intended use.

Manufacturing insurance settlement provides coverage for damages resulting from manufacturing defects, including injuries, property damage, and financial losses incurred by consumers.

This policy helps businesses address lawsuits related to faulty manufactured goods and mitigate the financial impact of recalls, repairs, and legal expenses.

Did You Know?

Manufacturing accounts for 11% of the U.S. economy!

Coverage For Design Deficiencies

Design defects occur when an item is inherently unsafe due to its design, regardless of how it is manufactured or used. Design deficiencies can lead to serious injuries or property damage and are a frequent source of product liability claims.

This usually happens due to negligence, which means that if it wasn’t up to the standard of care that was expected, then the organization will be held responsible for the injuries resulting in the defects.

So, it offers coverage for damages resulting from design defects, providing financial protection for businesses facing claims related to flawed commodity designs.

This provision enables companies to address design deficiencies and implement corrective measures to stop future incidents.

Protection Against Marketing Misrepresentations

Marketing misrepresentations occur when businesses make false or misleading claims about their items, such as exaggerated performance testimonials or inaccurate safety assurances.

These misrepresentations can lead to consumer injuries or financial losses and may result in product infringement complaints. It provides compensation for damages resulting from marketing misrepresentations, including compensatory and punitive damages awarded to injured parties.

This coverage helps organizations address claims related to deceptive advertising practices and protect their reputation in the marketplace.

Compensation For Personal Injuries And Property Damage

Product liability claims often involve personal injuries or property damage suffered by consumers as a result of using defective or unsafe manufactured goods.

Such injuries can range from simple cuts and bruises to serious injuries requiring medical treatment or property damage. Manufacturer’s legal remuneration offers coverage for medical expenditures, lost salaries, pain and suffering, and property damage resulting from product-related incidents.

This compensation helps injured parties recover from their losses and holds businesses accountable for the harm caused by their supplies.

Fun Fact!

5% of the results of personal injuries occur from Product Liability Issues!

Protection Against Legal Expenses And Settlement Costs

Defending against product liability claims can be pricey and time-consuming, involving different legal fees, court costs, and potential settlements or judgments.

Product liability indemnification provides coverage for legal defense expenses, including attorney fees, expert witness fees, and court costs incurred in defending against claims.

Additionally, indemnification covers settlement costs or damages awarded to injured parties, helping businesses resolve matters efficiently and mitigate the financial impact of litigation.

Support For Risk Reduction And Prevention

In addition to providing financial protection against commercial insurance claims, product liability insurance offers support for risk management and prevention efforts.

Insurance carriers often provide risk assessment services, safety training programs, and vendor testing resources to help organizations identify and reduce potential risks before they lead to a lawsuit.

By proactively addressing consumer safety issues and implementing preventive measures, businesses can reduce their exposure to manufacturer’s liability disputes and protect their bottom line.

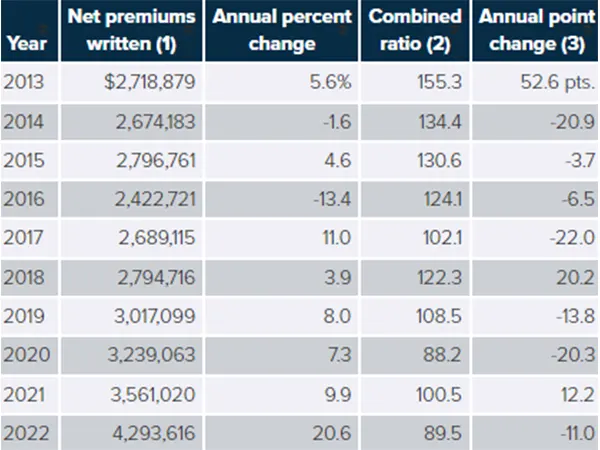

Did you Know ?

Records show that the highest amount of premium insurance taken for Product Liabilities was worth $2,718,879 in 2022!

Conclusion

Product liability indemnification offers comprehensive coverage for businesses facing a wide range of risks associated with the production, distribution, and sale of goods.

From manufacturing defects to marketing misrepresentations, it provides financial protection against personal injuries, property damage, legal expenses, and settlement costs resulting from goods-related incidents.

By investing in legal insurance settlements, organizations can safeguard their assets, protect their reputation, and mitigate the monetary risks associated with consumer insurance claims, ensuring the long-term success and sustainability of their ventures.