Smart Money Management for Disability: A Guide to Financial Stability

Living with a disability presents unique challenges, and one of the key aspects to navigating successfully is financial stability.

Effective money management becomes especially vital when dealing with the added complexities that physical and mental limitations bring.

Here are the best strategies for smart money management tailored to those facing disabilities.

By implementing these practices, you can pave the way for financial security, independence, and peace of mind.

Get Legal Help

In addition to the budget strategies, seeking legal assistance can be a valuable step in ensuring your rights and entitlements are protected.

Consult with an attorney specializing in disability law to understand the legal avenues available as per requirement.

If you live in Washington, hiring an Albany Social Security Disability Attorney can provide invaluable assistance in navigating the complex terrain of disability claims, ensuring to receive the support and benefits you rightfully deserve.

They provide guidance through the intricacies of benefits, assist in navigating workplace accommodations, and provide appropriate advice on estate planning.

THINGS TO CONSIDER

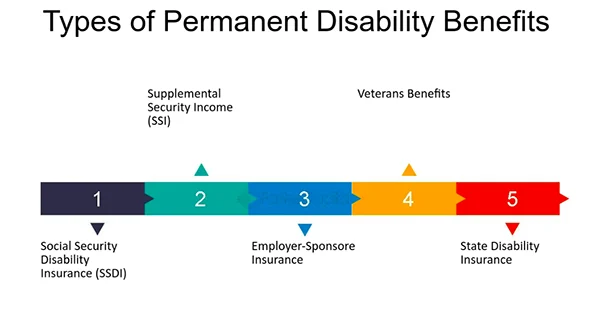

About 12.9% of the people in Washington State are disabled. Only those who fit Social Security’s definition of disability can apply for Social Security Disability Insurance (SSDI) benefits.

Embrace Budgeting Basics

Start with a detailed budget that accounts for your income, expenditure, and savings goals.

Understand the fixed and variable costs, and allocate a portion of your savings to an emergency fund.

This fundamental step sets the foundation for sound financial decision-making.

- Categorize Expenses: Break down the total spending into categories such as housing, utilities, transportation, food, and healthcare. This detailed categorization identifies areas that can potentially cut costs or reallocate funds.

- Track Spending Regularly: Regularly monitor the spending against the set budget. Utilize apps or spreadsheets to track transactions, to stay within budgetary limits. This practice enhances monetary awareness and helps to make real-time adjustments.

- Set Realistic Goals: Establish achievable budget goals that align with your current circumstances and future aspirations. If it’s saving for a specific purchase or building an emergency fund, setting realistic goals provides direction and motivation for a stable economic journey.

- Review and Adjust: Circumstances change, and so should your budget. Regularly review the economic conditions and adjust the budget accordingly. Stay adaptable to any unexpected events or changes in salary, ensuring the budget remains a practical and effective tool.

Leverage Government Assistance Programs

Explore the various government assistance programs available for individuals with disabilities. Familiarize yourself with eligibility criteria and application processes.

These programs can provide financial support, healthcare assistance, and other valuable resources to alleviate economic burdens.

Establish a Robust Emergency Fund

Building a robust emergency fund is necessary for everyone, but particularly for those managing dysfunctions. Aim for at least three to six months’ worth of living expenditure.

This buffer can act as a financial safety net during unexpected situations, providing peace of mind and stability.

- Set Clear Savings Goals: Define specific savings goals based on your monthly living expenses. Having a clear target makes it easier to stay disciplined and track progress.

- Automate Savings Contributions: Simplify the process of building an urgent fund by setting up automatic transfers from the checking account to the savings account. Consistent contributions, even if they’re small, add up over time.

- Review and Adjust Periodically: Periodically assess your economic condition and adjust funding goals as needed. Life circumstances and expenditures can change, so staying flexible ensures that an emergency fund remains relevant and effective.

- Avoid Temptation to Use the Emergency Fund Immediately: The purpose of an emergency fund is to cover unexpected spendings. Resist the urge to dip into this fund for non-emergencies. Having a separate account for discretionary spending helps maintain the integrity of your savings.

Prioritize Health Insurance

Health insurance is not just a safety net – it’s a fundamental pillar of financial security. Medical expenses can be unpredictable and significantly impact your budget.

Prioritize securing comprehensive health insurance coverage that meets your specific needs. Look for policies that cover a range of services, including doctor visits, medications, and specialized treatments.

Consider any additional coverage options that may be relevant to your disorder.

Explore Supplemental Income Opportunities

Consider exploring opportunities for supplemental income, such as remote work, freelance gigs, or part-time employment.

Leverage skills and interests to search for flexible avenues that accommodate your abilities and provide enhanced budget stability.

- Identify Remote Work Options: With advancements in technology, remote work has become more accessible than ever. Explore opportunities that allow work from home, leveraging your skills and expertise. Many companies offer remote positions, providing flexibility and accommodating various needs.

- Freelancing and Gig Economy: Tap into the gig economy by freelancing or taking on short-term projects. Platforms like Upwork, Fiverr, and TaskRabbit connect freelancers with clients seeking specific services.

- Part-Time Employment: Look for part-time employment opportunities that align with your abilities and schedule. Many employers are open to flexible arrangements, and part-time work can provide a steady salary stream without overwhelming resources.

- Monetize Hobbies and Skills: Turn your hobbies and skills into income-generating activities. When crafting, writing, or tutoring, there are platforms and local markets to showcase your talents. This not only adds to the salary but can also be a fulfilling way to spend your time.

The graph below compares the trends in employing disabled vs the general population in various sectors from February 2022 to February 2023.

Tackle Debt Strategically

To tackle debt strategically, start by creating a comprehensive list of all your outstanding obligations.

Categorize them based on interest rates, with higher rates taking precedence.

Consider negotiating with creditors to explore options for lower interest rates or more manageable repayment plans.

If feasible, allocate any surplus income or windfalls towards paying down high-interest debts aggressively.

Moreover, explore debt consolidation options to streamline payments and potentially reduce interest rates.

Invest for the Future

When securing your financial future, strategic investments play a pivotal role.

Diversify your portfolio to spread risk across various asset classes, such as stocks, bonds, and real estate.

Consider long-term budget goals and risk tolerance when making investment decisions.

While past performance doesn’t guarantee future results, a well-thought-out investment strategy can potentially generate returns that outpace inflation, preserving and growing your wealth over time.

Smart money management is the cornerstone of economic stability, especially for individuals managing disabilities.

By embracing budgeting basics, leveraging assistance programs, and prioritizing health insurance, you can build a solid foundation.

Establishing an emergency fund, exploring supplemental income, and strategically tackling debt are significant steps.

Investing for the future and fostering money management further contribute to your long-term financial well-being.