The Ultimate Guide to Investing in Penny Stocks

Investing in penny stocks can be like striking gold in a river of rocks, it’s rare, but the reward can be enormous.

However, with great rewards come great risks; one wrong step and your treasure hunt can quickly turn into a money pit.

This guide is designed to be your compass, steering you through the turbulent waters of penny stock investing.

For a fledgling investor or a seasoned trader looking for new insights, this comprehensive guide will be a valuable aid in navigating the world of minnow market investments.

Understanding Penny Stocks: The Basics

Often referred to as micro-cap stocks, penny stocks are shares of small companies with a low market price.

Their allure lies in their supposed affordability, often defined as trading for less than $5 per share.

They’re typically issued by companies with a short, less visible track record, making them high-risk, high-reward assets.

The definition of a low price can vary by personal finance standards, so it’s relevant to evaluate carefully in the context of your overall investment strategy.

You may want to dive into Psychedelic penny stocks or think about electric vehicle start-ups, always remember that research is key to understanding this business.

So look online, read financial statements, listen to webinars, and take the time to understand what you’re investing in.

THINGS TO CONSIDER : Try paper trading before investing in penny stocks. It is a technique of simulating trading for investors to practice buying and selling stocks without using actual money.

The Appeal of Penny Stocks: The Pros and the Promise

Investment should always be preceded by a strategy because without that it’s like taking part in a bullfight without heeding to its dangers.

The low price of stocks is tempting, which attracts a lot of beginner investors. However, knowledge is the power to navigate confidently and avoid heavy losses.

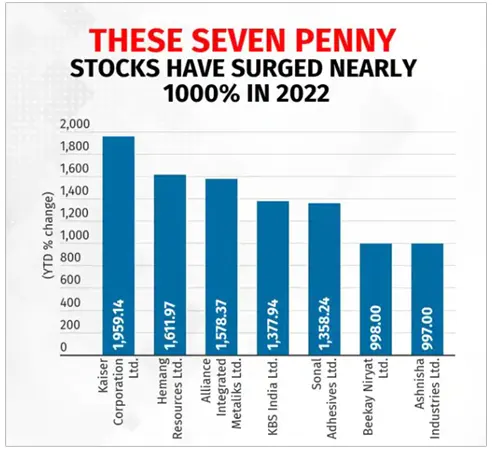

The Siren Call of High Potential Returns

Penny stocks are known for their potential to deliver exponential returns because of their low price.

Any significant increase in the asset value can lead to a substantial percentage gain for the investor. Consider the promise of a stock that doubles or triples in value.

Accessible to All: Low Entry Barriers

For budding investors, especially those on a tight budget, penny stocks offer an attractive entry point into the world of stock trading.

With shares often available for mere cents, they’re a means of breaking into the market without significant initial capital.

Hidden Gems: Diversification Opportunities

For seasoned investors, micro-cap stocks can offer diversification opportunities. By adding pennies to a portfolio, albeit carefully, you spread out the risk across a wider range of assets, which can be necessary for robust investment strategies.

The Caveat of Penny Stocks: The Cons and the Cautionary Tales

Lack of trading knowledge is just one aspect that is often overlooked when investing in penny stocks.

When you don’t understand a company’s stand in the market, there are more chances of you incurring huge losses.

A Wild Ride: Volatility and Liquidity Conundrums

Penny stocks are notorious for their unpredictability, as their low trading volumes can amplify price swings, making them extremely volatile.

As such, they demand a high level of market monitoring and risk management at all times.

Also, because they’re not listed on major stock exchanges like the NYSE or NASDAQ, liquidity can be an issue.

This illiquidity means that when you want to sell your shares, it may not be immediately available.

Fraudsters and Scammers: The Dark Side of Penny Stocks

The world of penny stocks is unregulated and susceptible to manipulation by fraudsters and scammers.

These bad actors manipulate asset prices by hyping up or falsely reporting on the company, deceiving investors into buying shares at inflated prices.

This pump-and-dump scheme is a common type of fraud and can lead to significant losses for unsuspecting investors.

A Darker Side: Lack of Regulation and Transparency

One of the common criticisms of penny stocks is the lack of regulatory oversight and company transparency.

Investors often lack the financial information necessary to make informed decisions, leaving them exposed to potential deceit or fraud.

The Risk of Temptation: The Pump-And-Dump Menace

The scheme is simple but insidious, something that most fear because it seems to be too good to be true.

Fraudsters artificially inflate the price of a stock (“pump”), then sell their own shares at the peak, causing the price to plummet (“dump”), taking advantage of unwitting investors who buy at inflated prices.

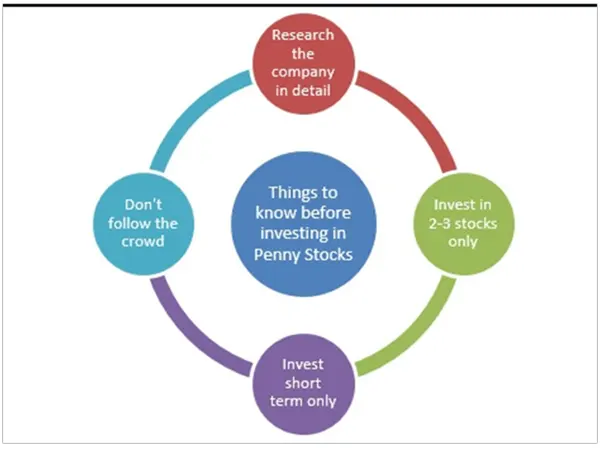

The Path to Wise Penny Stock Investing: Strategies and Approaches

Investing in penny stocks isn’t just about opting for the best one; it’s about adopting the right mindset and strategies. Here’s how to approach it with prudence and preparation.

The Launch Pad: Research and Due Diligence

In the volatile world of trading, knowledge is power, therefore, scrutinize company financials, management, market trends, and news.

Always verify and cross-check information from multiple sources, and look for signs of long-term viability.

Setting the Coordinates: Realistic Goal Setting

Don’t risk more than you can afford to lose is a good idea, especially in these types of dealings. Approach with a well-thought-out plan and set realistic short and long-term goals.

Understand that the overblown promises of many might not be realistic, and be prepared for the bumps in the road.

The Life Jacket: Risk and Reward Management

Risk management is necessary, and therefore limits the percentage of your portfolio that you allocate to penny stocks.

Employ stop-loss orders to protect gains and minimize losses, as this type of investment doesn’t have to be an all-or-nothing affair.

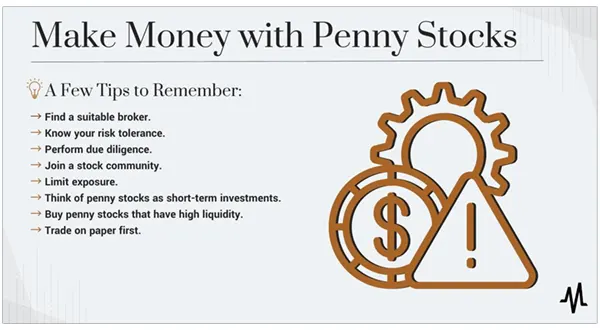

Maneuvering the Penny Stock Waters: Best Practices for Success

Success in penny stock investing requires constant vigilance and a willingness to adapt. Here are some best practices that can guide you to success.

Navigating the Swells: Monitoring Market Trends

Keep an eye on market trends and be ready to adjust your portfolio accordingly. Develop a watch list of stocks you’re interested in and follow their performance and any news that could affect their value closely.

Charting Your Course: Learning From Mistakes

Reality check: losses will happen. Each loss can be a lesson and at a fraction of the cost associated with other assets.

Use these as opportunities to improve your strategy, decision-making process, and emotional discipline.

Following the Lighthouse: Seeking Expert Advice

Connect with experienced investors, and financial advisors, and use investment platforms that can offer insights into the world of stocks and trading.

Even if it means paying for advice, the cost may be substantially less than the price of a misinformed investment decision.

In the end, investing in penny stocks is not for the faint of heart. It requires a level of diligence, discipline, and a willingness to accept risks that may not be everyone’s cup of tea.

For the intrepid investor willing to put in the effort, heed caution, and learn the nuances of the stock market, the potential rewards are as unlimited as the asset prices are low.

Remember, money is as easy to earn as it is to lose, in the right circumstance and with the right skill, your investment might just become a dollar, or a hundred.

Until then, be diligent, set realistic expectations, and with strategic planning, you will be successful in the long run.

May your investments be fruitful, and your losses be instructive. Happy trading!