How to Transfer Apple Cash to Bank Account and Debit Card With Some Straightforward Steps

Are you someone who recently came across Apple Cash? And want to know how to transfer Apple Cash to your bank account? Need not ponder over it any longer; you can just execute it with some clicks. As you move forward in this article, you will be provided with clear-cut steps for doing so.

But make sure that you possess a bank account. Banks like Venmo provide the liberty to its users to add money to Venmo without a bank account; however, in the case of Apple Cash, this is invalid.

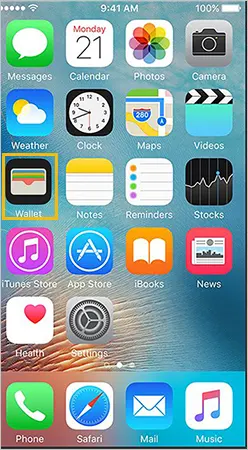

Apple Cash is a digital card that allows you to send and receive payments, and automatically appears in your Apple Wallet once your iPhone is set up. In order to enable transferring features on this platform, you must know the process of transferring Apple Cash to a bank account. This query can be resolved by applying two methods, i.e., Bank transfer and instant transfer.

To learn the process of transfer on this platform, cast your eyes and mind over the topics that are discussed in this article.

- Can You Transfer Apple Cash to Bank?

- How to Transfer Apple Cash to Your Bank Account?

- Ways to Transfer Money From Apple Cash to Debit Card

- Why Won’t My Apple Cash Move to My Bank?

- Fees and Transfer Limits for Apple Cash

- Eligible Cards and Banks Supporting Instant Transfers

- What’s the Difference Between Apple Cash and Apple Pay?

- Streamlining Your Finances

Can You Transfer Apple Cash to Bank?

Yes, you can transfer Apple Cash to the bank, but make sure that your bank allows you to access Apple Cash via your bank account. It can be used to make Apple Pay purchases or transfer funds to a linked bank account. Keep in mind that any Apple Cash you receive never goes to your bank directly; it goes straight to your Apple Cash balance.

So, many users have asked on several platforms, ‘Can you transfer Apple Cash to a bank account?’ Here is the accurate response to it. Yes, you can do that by applying two methods.

These two methods are a bank transfer and a debit card. And if you are someone who wants to execute the safest payment method, you can go for a bank transfer. In case you want your faster, you can use the debit card method.

How to Transfer Apple Cash to Your Bank Account?

Don’t know how to transfer Apple Cash to the bank? Relax; you don’t have to be a financial expert to do so. Here, I have brought to you the simplest steps for doing so. But keep in mind that you cannot omit any step, and you have to add a bank account to Apple Cash before following the underlined steps.

There are two methods for hassle-free transfer of Apple Cash to the bank. Firstly, we will explore the most common method for doing so, i.e., bank transfer.

Follow the below-mentioned steps for transferring funds from this platform to the bank.

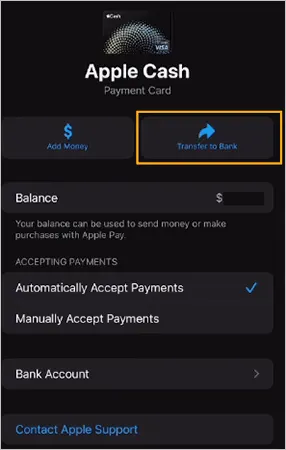

- Open the Apple Wallet application, and select your Apple Cash card.

- Try to locate the More option represented by three dots.

- Click on the Transfer to Bank button.

- Manually enter the amount you want to move to your bank account and click on Next.

- To finalize the transfer, click on the Confirm the Transaction button.

- Tap on the 1 to 3 business days and confirm by passcode, Face ID, or Touch ID.

If you follow these steps without skipping any of the steps in that scenario, you will be able to successfully slide Apple Cash to your bank account.

Ways to Transfer Money From Apple Cash to Debit Card

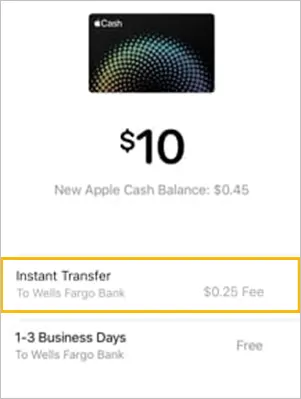

The other method for transferring funds from this platform to the bank is through instant transfer/debit card. Before going ahead, ensure to add a bank account to Apple Cash. Let’s now learn how to put Apple Cash in the bank. Here are some quick and easy steps to follow for transferring funds from this platform to the bank via instant transfer.

- Visit the Wallet App, then tap Apple Cash and next select More.

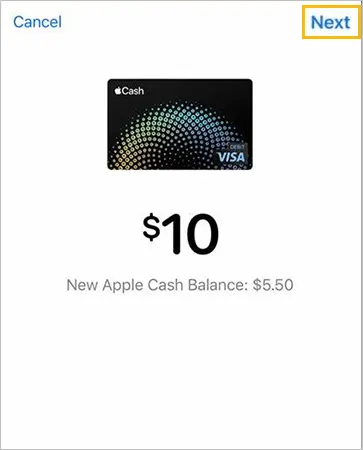

- Tap the Transfer to Bank option, enter the amount you want to transfer, and click Next.

- Tap on Instant Transfer. If you have yet to add a debit or Visa card, select the Add Card option.

- Select the Visa card you want to send Apple Cash to. And confirm the transaction with your FaceID, TouchID, or passcode.

Note: A 1.5% fee will be deducted from the amount that you transfer.

Once you execute these steps as instructed, this transaction will reflect in your bank account within 30 minutes of its initiation. This is how you can execute an Apple Cash transfer to the bank instantly using a debit card.

Why Won’t My Apple Cash Move to My Bank?

Are you someone who is facing issues with Apple Cash transfer to bank? Don’t know what to do? You need not worry any longer because here, I have listed a few things you should check before contacting customer care personnel. There could be diverse possibilities for this issue, let’s explore the most prevailing reasons for it.

- Make sure your device is up-to-date. Go to Settings > General > Software Update to be sure.

- It could also be due to some kind of bug.

- Double-check your account credentials, maybe due to human error you are facing this error issue.

- For a transaction to be initiated and executed, you require a stable internet connection. Make sure your internet is working well.

- Another possibility would be you’re surpassing transfer limits. You can only transfer between $1 and $10,000 at a time, and only $20,000 every seven days.

- If you have used accents when typing in your name could also be one reason, which is actually a glitch in this payment platform.

- Don’t hesitate to ask your bank whether your debit card is valid on Apple Cash or not.

Try to check these troubleshooting points, I believe you would be able to resolve this issue yourself. If the issue still remains unresolved, in that scenario, you can contact Apple Support at 1-800-275-2273. You can also contact them if you face issues regarding how to get Apple Cash to your bank account even after executing the above steps.

Fees and Transfer Limits for Apple Cash

Before delving deeper into the process of how to get Apple Cash to the bank, it is necessary to acquaint yourself with the fee and transfer limit of this platform. If you choose the conventional approach of moving Apple Cash to the bank, it could take some time but is free. Additionally, if you use your debit card to make a fast route instant transfer, you will be charged 1.5% of the transfer amount, with a minimum fee of $0.25 and a maximum fee of $15, each time you do it.

Its competitors like Cash App charges more transfer fees than it. But for compensation, it provides ample opportunities to make free money on Cash App.

The below table reflects the balance and transfer limits of this platform.

| Balance Limits | Transfer Limits |

| Maximum Balance you can hold up to$20,000. | Apple Cash Family members, sending or receiving per message limit is $1 minimum and $2,000 maximum. |

| Apple Cash Family members, the maximum account balance limit is $4,000. | Bank account or debit card, you can transfer a minimum of $1 and a maximum of $10,000 in a single transaction. |

| For Apple Cash Family members, the minimum transfer limit to a bank account or debit card is $1 and the maximum is $2,000. |

These are some of the fees and transfer limits that you should keep in mind before initiating and executing a transaction.

Eligible Cards and Banks Supporting Instant Transfers

Make a mental note that instant transfer is not accessible outside the USA. Moreover, this special feature is not available with every bank’s debit card. The prerequisite for this is that all the cards should be issued by US banks. If you fulfill the basic requirement, you will be easily able to grasp the process of how to move Apple Cash to the bank.

Following are some debit cards that are eligible for Apple Cash transactions.

- VISA Cards

- Master Cards

- American Express

- Flexible Spending Accounts (FSA)

- Health Savings Accounts (HSA)

- Health Reimbursement Arrangements (HRA)

Visa and Mastercard are one of the most popular options when you consider transferring Apple Cash to a bank.

Banks Supporting Instant Transfers

There are a handful of banks in America that support instant transfers. This transfer does not let you wait for 3 to 5 business days for receiving your money.

Now, let’s just look at the list of banks which provide the service of instant transfers.

- HSBC

- Capital One

- Chase

- Citi

- Wells Fargo

- American Express

- Bank of America

The instant transfer fees may fluctuate between 0.25% to 10% depending upon the amount and bank you opted.

What’s the Difference Between Apple Cash and Apple Pay?

There are a whole lot of people who have asked or searched about the difference between Apple Cash and Apple Pay. Are you also one of those who often confuse these two Apple Wallet features? Let’s erase all your perplexity by drawing an in-depth comparison between these two services.

| Apple Cash | Apple Pay |

| It is a way of transferring money between people, quite similar to PayPal. | It is a way of using your preexisting supported credit cards to make contactless purchases at supported locations. |

| Apple Cash is available only in the US. | Apple Pay is available in a bundle of countries like the United Kingdom, Canada, Spain, Australia, and many more. |

| This feature of the wallet allows you to make contactless payments. | This feature of the wallet permits you to send and receive payments via messages. |

What needs to be noted is that both of these features are stored in Apple Wallet. Apple Pay is a one-stop solution for all the payment solutions, on the other sunny side Apple Cash is a balance and transfer of funds solution.

Streamlining Your Finances

You should be able to transfer Apple Cash to your bank account fast and securely if you follow the instructions provided in this article. You can streamline and simplify your money for both you and your family by making use of Apple Cash and Apple Pay. Furthermore, you won’t have to ponder over carrying a wallet in your pocket if you enable these features of Apple Wallet by linking your bank account.

But what needs to be kept in mind is that availability of funds from Apple Cash to your bank entirely depends on your choice. You can either opt for a bank transfer which takes 2 to 5 business days or an instant transfer which takes 30 minutes with some fees.

Sources: