Cash App Scams: 12 Common Scams and How to Avoid Them in 2024

According to the Hindenburg Report, 9% of Cash App’s total of 45.5 million users get scammed every week, which is alarming.

You would hear many suggestions from people, like deleting Cash App history to safeguard yourself from Cash App scammers. However, follow these recommendations carefully. Read this article carefully to learn more about Cash App scams and how to identify them.

In this article, I have listed the twelve most common Cash App Scams and discussed how to avoid them.

Is Cash App Safe?

What Is Cash App and Is It Safe?https://t.co/Jp7xtxDfWo pic.twitter.com/Lzk8IRe8hB

— Consuming Tech (@consumingtech) February 8, 2023

Yes, Cash App is a secure P2P app. It includes many security features, such as encryption, Touch ID, Face ID, and fraud detection technology, that prevent others from accessing your credentials.

However, scammers do find loopholes and attempt to trap users in their scams. This article will go over the various Cash App scams you should be aware of and how to protect yourself from fraudulent Cash App transactions. It will also explain how do Cash App scams work and what you should do if you become a victim of one of these scams.

Also Read: Cash App Payment Pending Issue: Reasons, Solutions, and More

12 Common Cash App Scams in 2024

Many users have recently reported Cash App scams, so it is important to be aware of how scammers can catch you in their honey trap. Here are the ten most common Cash App scams that can result in money loss.

Cash App Flipping

New method cash app flipping pic.twitter.com/XoDsVK9DU6

— Amanda Dorris (@mnddorris) March 8, 2023

In this Cash App scam, you receive a message from someone requesting that you send them a certain amount of money. Then, when you transfer the funds, the individual guarantees you will receive an even larger sum of money back.

They will also claim to confirm your identity before transferring the funds. This is a scam, also known as a “Money Flip or Circle”, in which there is no return on investment.

#CashAppGiveaways or #CashAppFridays

Elder relative who has NO CLUE how @CashApp operates:

— Uncle Anakin (@Deuce80Fitz) September 21, 2019

“It’s got to be a scam, no social media account is giving out free money and don’t want nothing in return.”

Me: “Yes they do!! On Me‼️”

Elder: “On what?!”

Me: #CashAppFriday #CashApp #CashAppFridays pic.twitter.com/Ca3lEOObiC

#CashAppFridays is one of the most perplexing Cash App scams. Every Friday, this payment app uses this hashtag to promote its giveaway program, which rewards customers with cash.

Cash App scammers often pose as salesmen. They track down users from the #CashAppFridays comments section and informs them that they have won, but that they must first pay a fee before receiving their winnings.

However, they must provide payment or login information to claim their prize. True winners will never be asked for credentials or payment.

Catfishing or Bad Romance Scams

Did you receive a random text on the App stating that you were their love interest? Be cautious; this could be a catfishing scam. Catfishing is a type of online romance scam in which a scammer assumes a phony online persona to lure a victim.

It usually aims to steal the victim’s identity or harass them. They beg for money by cooking up some emotional stories, which the victim falls for and loses their funds.

Fake Refund/Payment Scam

Hey @lolslimlol did u refund the money u scammed from @HilgersAdam yet? Or any of the other ppl u have stolen thousands from? U literally have at least 6 cash tags and have used all of them to scam ppl. @CashApp @CashSupport will @HilgersAdam be refunded? He has proof pic.twitter.com/wHf8WHYDtC

— mugiwaraart (@MacuIae9) January 21, 2023

If you own a small internet business, you may encounter this scenario. Someone sends you a message saying they are “interested” in what you are selling and will pay you via the Cash App.

The con artist then uses deception to trick you into believing the money was sent twice, and they threaten to take your real money in exchange for a refund. But the truth is that they never paid you.

Moreover, I noticed that a random person sent me money on Cash App recently, when I researched more about it, I realized it was some sort of payment Cash App scam.

Phishing Scams

Mr. Khan, this is the wrong post and the wrong people to pitch your silly phishing scams to. pic.twitter.com/lbc5bYAaLG

— John Chau (@JChau95) January 7, 2023

Phishing is the practice of pretending to be a reliable source. A message is sent to anyone who has this payment app to steal information by asking for the password, username, or Cash App password. Genuine Cash App emails will never request login information or use threatening language.

Fraudulent Cash App Support Personnel

To anyone that tried to get the "free money" from @CashAppBanking1

— Audi Westfall (@audiwestfall) August 9, 2019

I emailed customer support for cashapp that stated this is Fraudulent! pic.twitter.com/dNDiBJmIhf

A common Cash App scam involves someone contacting you posing as a member of the Cash App support team and asking for personal information such as your PIN, SSN, or password.

The caller may ask you to confirm information that appears innocent but has a hidden agenda. So, never give them sensitive information; instead, hang up the phone and report it as a scam.

Investing Frauds

Con artists initiate this fraud by sending emails promoting fictitious investments that you will not want to miss. You lose the money they promised to invest when they disappear after taking your money for the investment.

Real Estate Scams

#Scams Milwaukee Facebook CashApp rental scam eviction warning https://t.co/i1oVLqITsA pic.twitter.com/cME2ZPsvxs

— FilthFinder (@filthfinderbot) March 3, 2022

If you live in the United States, you are probably aware of the scarcity of reasonably priced housing. As a result, scammers try to dupe people by claiming they can find a flat for much less than the market rate if you send them a deposit via Cash App. However, you lose the money you paid for the deposit, and the scammer needs to provide the promised service.

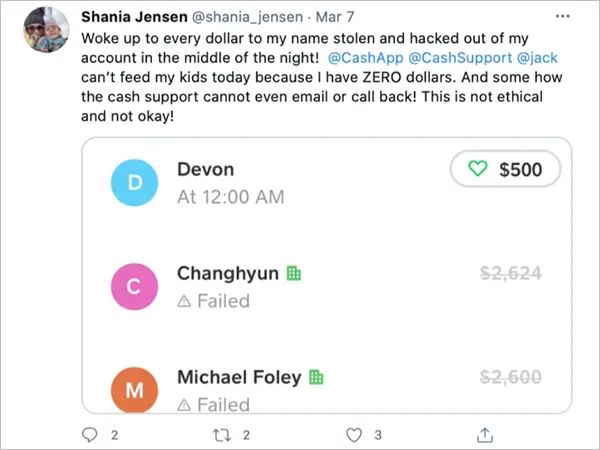

Cash App Account Hack

Have you enabled all the Cash App’s security features? Be cautious! Your payment account could be hacked at any time.

Even if scammers cannot steal your money simply by guessing your Cash App username, they may be able to take over your account if you do not use strong password security.

Hackers can find out if you use the same password for multiple accounts by purchasing password lists and testing the credentials on a variety of online accounts.

False COVID-19 Schemes

A flurry of new schemes was sparked by the worldwide pandemic. With a large portion of the world still feeling the effects of the virus, hackers have attempted to profit from the fear through dishonest means.

Anything related to COVID-19 can be used to deceive; for example, offering money in exchange for vaccinations or requesting funding for government relief efforts through the Cash App. The moment you are asked for money or account information, you can be sure of the Cash App scam.

Cash App Scams on Facebook

Do you know Cash App scams on Facebook are very common? Did you also become prey to these scams or recently heard of them? Let’s learn how it actually works.

In this kind of Cash App scams on Facebook, you see ads on different Facebook pages where they promote that you can click on the link to redeem the benefits or get money on your Cash App. Beware! They are actually scammers trying to sneak into your payment app and rob you of your funds.

Pet Sale Scams

Are you someone who loves to keep pets? If yes, beware! Scammers pose as breeders, actors, or pet shelter providers and post ads on social media platforms to gain your attention.

When you approach them they will try to swindle you into paying deposits through Cash App to get hold of the pet. They can trick you by stating it’s an adoption program, pose as a breeder, or build a story that they can’t keep the pet with them any longer due to personal reasons.

It is quite rare to identify scammers as they will quote very cheap and persuading pricing. To get things done quickly they will say that you will miss the opportunity if you don’t make the Cash App payment soon. Once, you make the payment they will suddenly be eradicated from all the platforms and you will lose the money present in your Cash App account.

These are the twelve most common Cash App scams that are terrifying payment app users. However, if you exercise caution, you can effectively avoid these scams.

Also Read: How to Make Money on Cash App Using Fast and Easy Ways?

How to Avoid Cash App Scams?

There are a few things you should avoid if you do not want to become a victim of Cash App scammers.

- Each Cash App user has their own distinct “Cashtag”. Before sending money via Cash App, make sure the recipient’s Cashtag is correct.

- Emails that don’t appear to be from reputable email addresses should be ignored.

- Never turn off two-factor verification.

- Avoid doing business with strangers.

- Never respond to scammers send me your Cash App information request.

- Contacting customer service through their app is one of the most viable options.

- Make sure you never share your personal ID and details with third parties.

- Make sure you do not spend too much money on the app.

- Avoid clicking on strange links.

- This app should not be used for rental deposits.

- If you are offered free prizes or asked for information for cash back, ignore these offers rather than fall victim to a Cash App scammer.

Keep these things in mind while using this app and safeguard yourself from scammers.

What Should You Do If You Fall Victim to a Scam?

If you fall victim to a Cash App scam, there are some quick steps you should take in an emergency. Go through the pointers listed below to learn more about them.

- Contact customer support to report the scam, and immediately discontinue all contact with the scammer.

- If you lose money, it is often advised to report it to the Internet Crime Complaint Center and the Federal Trade Commission.

- Inform your bank, if applicable, of any potential fraudulent charges. Check your credit report to ensure that no further damage has been done.

- Change the password on your Cash App account. Use a unique password with at least 12 characters for each online account you have.

- Keep all of your passwords in a password manager to protect your account in the future.

- Urgently dispute your scammed transaction on the app.

| Cash App Login > Fraudulent Transaction > Tap Three Dots > Need Help & Cash App Support >Dispute this Transaction |

Although there is little chance of receiving your money back, it is still important to report these Cashapp scams because their tracking can help other users avoid financial loss.

Also Read: How to Delete Cash App Account Easily?

Cash App Safety Features

This payment software offers a variety of settings to guarantee that transactions stay safe and secure, which helps users with security and privacy.

Switch on the Security Lock

If the Security Lock option is on, users will be prompted to enter their password each time they make a payment. This adds an extra layer of security and ensures that the user approves all payments.

| Cash App Mobile App > Profile Icon > Select Privacy & Security > Toggle Security Lock > Enter Cash PIN |

Cash App Card Disabling

When a card is lost or stolen, spending can be immediately halted. Furthermore, if this payment app finds something suspicious about the transaction, it may also block the card.

Activate the Text and Email Notifications

When a payment is made, you can choose to receive email or SMS notifications. If a payment that you have yet to make is ever processed, you will be notified immediately.

Encryption and 2F Authentication

Encryption and two-factor authentication protect user data, and fraud detection algorithms look for unusual activity.

This payment app provides some safety and security features. Enable them to safeguard yourself from any Cashapp scams.

Also Read: How to Add Paper Money to Cash App at Different Outlets in the U.S.A. [Complete Guide]

Conclusive Thoughts

It is critical to be aware of the various Cash App scams that exist and to take precautions to avoid becoming a victim of these deceptive schemes. Scammers frequently change their strategies, so it is critical to stay vigilant and cautious.

To protect yourself and the larger Cash App community, you must keep up with emerging frauds and educate others about the risks involved. It’s important to keep in mind that Cash App support will never ask for your PIN. You should also report any scams you suspect as soon as possible to help prevent others from becoming victims.

Also Read: How to Deposit a Check on Cash App? A Complete Guide

FAQs

Ans: Sending and receiving money from strangers is risky and can cause you trouble. Ensure that the Cash App is using 2-factor authentication for you.

Ans: Instant payments are typically irreversible because they are processed in minutes on a priority basis. However, Cash App takes steps to keep an eye on your account for any unusual behavior and has the power to reverse any fraudulent payments.

Ans: First and foremost, the Cash App Support team will never call you and ask for your personal information, such as SSN, PIN, or Password. It does not require you to install any apps on your device. If someone does this, it is a scammer attempting to gain access to your account.

Ans: No, a scammer cannot steal your money based solely on your username and ID.

Ans: The security of our Cash App account is not jeopardized by sharing a Cashtag alone. But, it’s wise to keep your Cash App tag private and only communicate it with those you can trust when necessary, rather than posting it on open forums.

Ans: It is often advised to not send or receive money from strangers as you could become prey to some sort of scam.

Ans: Before accepting the request, inquire from your friends and family, if they didn’t send you the money, then it could be a spammer trying to trick you. The best thing to do is decline the request and block the receiver.

Sources: