Boost Cash Flow in Your Company with These Tried-and-True Methods

Think of your business like a rocket, ready to launch with a fantastic idea. But there’s a problem: not enough money.

Now, here’s the puzzle: when should you try to grow, make things smoother, or ask for support?

No need to worry; there’s a solution.

Picture cash flow as the energy that keeps your business going. Boosting it is like giving your rocket more power.

It lets you take exciting chances, grow, and make your business even better. It’s like topping up the fuel in your rocket for a journey to new places.

Are you ready for a successful takeoff?

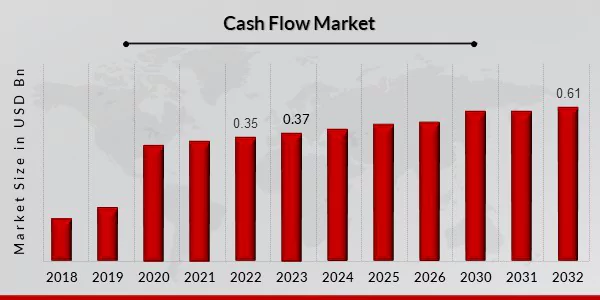

Let’s look at the cash flow market evaluation, which reveals a promising outlook.

Statistics:

Projections indicate a compound annual growth rate (CAGR) of 6.40%, poised to elevate the market from USD 0.37 billion in 2023 to USD 0.61 billion by 2032—a notable growth trajectory.

Cash flow planning is one of the key points set by business owners to streamline profits.

It’s also the thing that they dread the most, due to the effort spent on:

- Monitoring

- Evaluating

- Optimizing cash inflow and outflow

To navigate this challenge, explore proven methods that inspire ways to enhance cash flow and bolster your financial strategy.

Boosting Cash Flow in Your Company: A Brief Overview

At any point in time do you ever feel like there’s always money going out of your business before there’s money coming in?

The harsh reality of business is that it’s a game of numbers.

Regardless of whether your business is growing at a rampant pace and profit increases, you are certainly headed in the right direction.

But we suggest you don’t put your guard down, since grown enterprises can be hit with cash flow problems.

Richard Branson once said, “Never take your eyes off the cash flow because it’s the lifeblood of business”.

Without the right financial figures, you won’t be able to hire new employees, expand your operations, or even pay your bills on time.

Keep this in mind, working with numbers isn’t just vital but rather decisive to your success. The more money you have coming in and going out, the better off you’ll be.

Many business owners struggle to keep a company afloat and meet their financial obligations. That’s why boosting cash flow is influential for any company owner.

5 Strategies to Boost Cash Flow in a Company

Cash flow can make or break your business. When you can’t pay your suppliers, employees, and other bills, everything else becomes a lot more difficult.

Michael Dell, founder and CEO of Dell Technologies says, “We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas”.

If you are struggling to manage your cash flow, here are some tried-and-true methods to help improve it.

Reduce Expenses

The best way to boost cash flow is to cut costs. Look for areas where you can reduce spending without affecting service or quality.

For example, if you’re paying for software licenses that aren’t being used, consider getting rid of them or negotiating a better deal with the vendor (for example, by switching from perpetual licenses to subscription-based pricing).

Reducing expenses often involves making difficult decisions about what’s necessary and what isn’t. The key is to ensure that all changes will positively impact your bottom line before implementing them.

Note: Ask about bulk discounts or other incentives that could lower your costs without compromising quality too much (if at all).

Increase Revenue

Once you’ve identified where there are opportunities for cost reductions, it’s your call to turn your attention toward increasing revenue through marketing efforts and sales promotions.

Interesting Fact:

Shortly, 10% would invest in employees through hiring, wages, and benefits.

It includes everything from creating a website that sells products online to advertising in local newspapers or magazines or even on billboards around town—anything that will help bring in more customers and increase sales volume overall.

For example, you should make sure that your website is appealing to your audience and easy to navigate through.

You should also ensure that all of your products or services are listed on the site so that customers know what they are buying before they purchase anything from you.

Note: Try video marketing. Script to video is a simple concept. Generate leads and close sales by increasing your exposure and showcasing your products and services in videos.

Monitor Payments

Invoices are necessary tools for tracking payments, but they’re also a source of cash flow problems if they’re not paid quickly enough.

Make sure that your invoices are clear and easy to understand—don’t use chunky fonts or confusing formatting—and streamline the process of transitioning from text to video.

Double-check every invoice before sending it out so that there aren’t any mistakes (like incorrect addresses or phone numbers).

Make sure everyone at your company understands what they need to do when they receive an invoice if it’s paying it immediately or asking for an extension.

Note: If you have existing debt, such as a line of credit or an equipment lease, review the terms and see if it makes sense to refinance or restructure it.

Automate Processes

When you automate a process, it means that you’re doing it through software or another program instead of manually.

This can be anything from creating an invoice template to filing invoices automatically once they’ve been approved.

Do You Know?:

43% (more than two in five) of small business owners with cash flow issues are at risk of not being able to pay their employees by their designated payday.

Automating processes cuts down on time spent on administrative tasks and allows employees to spend more moments on revenue-generating activities such as selling products or services.

Eliminate manual checks and balances in systems that require them.

If there are multiple steps required before something gets completed (for example, billing customers), try reducing the number of steps with automation.

Note: By creating an automated system for payments and billing, you can reduce the amount of time it takes for vendors to receive payment. And we all know that time is money.

Evaluate Inventory

Conduct an accurate inventory count and determine how much it costs to store your inventory.

Some companies have in-house staff to complete this task, while others may outsource this function to third parties like accountants or auditors.

Once you have a clear picture of what your inventory looks like, you can begin to plan ways to reduce it or increase its value.

Inventory management is an influential factor in cash flow management. Having too much inventory costs money in two ways:

- Ties up capital, which could otherwise be used to generate revenue

- Increases the risk of obsolescence

Items can lose their value quickly and become obsolete before they can be sold.

To avoid this problem, businesses should regularly evaluate their inventory and remove items that are not selling well or are no longer needed.

Note: It’s time to change your product line or service offerings and price points if you’re unable to sell your inventory.

Improve Collection Policies and Procedures

Improving your company’s collection policy and procedures is not just about cutting off delinquent accounts.

It’s also about making sure you have a consistent process for handling accounts in good standing.

You should also have a way to track past-due amounts and make sure they’re getting paid before they become too large.

If you don’t have a good handle on what’s going on with your receivables, you should start investing some moment in improving the situation.

For example, you may consider implementing a strict policy for customers who are more than 30 days late on their payments.

You could also implement a new billing system that automatically sends out reminders for overdue invoices. This will make it much easier to track accounts that need additional follow-up.

Note: Many companies offer discounts for early payment of invoices, hence encouraging vendors to pay sooner rather than later.

Key Takeaways

- Managing your working capital is compulsory for a thriving company. And, healthy cash flow ensures operations run efficiently and smoothly.

- Regardless, these five strategies can make it easier when making them a habit.

- Consider automating processes and working out good deals with your vendors to boost your working capital.

- Using credit wisely and keeping a close eye on your cash flow is key.

- Making sure you’re making the right decision, such as setting aside a small surplus, strengthens your cash flow in different ways.

- During tough times you can use these techniques to get your company back on track. With a bit of effort, you can kick-start your journey to clear debts and adopt better business practices.

- Once things are stable, it will be up to you to decide what comes next: maybe take on a larger project or experiment with an innovative new product launch.

- After all, cash flow gives you the freedom to keep growing your business at a rate that matches your company’s needs. So, embark on being a happy, successful, cash-flow-positive business owner.